401(k)-A system that has Falied many Americans....

Did you know that the 401(k) wasnt designed as a retirement plan, in fact it was designed to be a employer based savings plan for its employees? Did you know 401(k)'s actually payout on an average of 5%-8% annually? Did you know inflation averages 2%-4% per year? That means it really is a glorified savings account YOU CANT ACCESS BUT THAT ALL STOPS NOW!

Brief 401(k) History Lesson...

Creation of the 401(k)in the year 1981

Yes 401(k)'s have only been around for the past 40 years. This is when the IRS issued new rules that allowed employees to contribute to this "Savings" account through salary deductions which jumpstarted this so called "retirement" account which really isnt a retirement account. Its nothing more than a mere employee savings account.

Bull Markets Grew 401k's Giving False Sense

Two Market Bull Runs...

There were two major market bull runs in the 80's and 90's which pushed 401(k) accounts higher. Then two recessions in the 2000's erased those gains and prompted second thoughts from some early 401(k) champions. Those to had rode out the highs and lows, have begun to realize these are NOT a place to have their long term retirement monies nor can they rely on their funds to be SAFE in a 401k. Just look at the 2007 mortgage melt down, everyones 401k became a 201k or lower losing up to 70% or more of their entire 401k savings. All of which they had ZERO control over.

What makes up the 401k

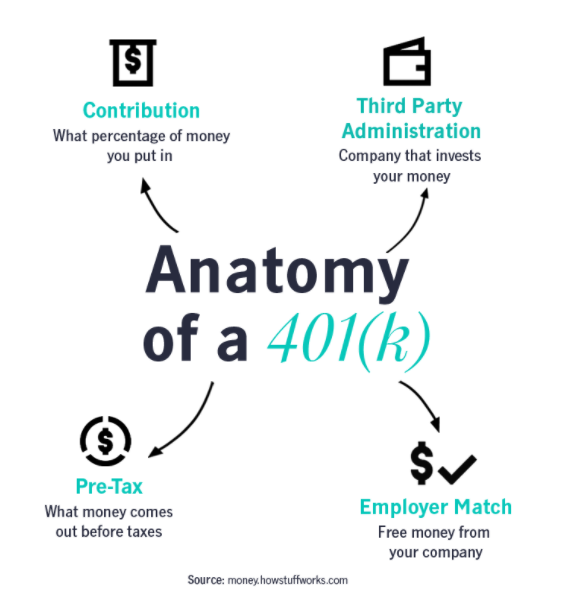

The 401(k) Anatomy

The 401(k) is comprised of 4 different things.

1.) 3rd PARTY ADMINISTRATOR: You have a third party administrator that sets up a 401(k) plan option for your employer (this is a financial institution that only offers their products such as a combination of stocks, bonds and mutual funds) who then offers this plan to its empoyees.

2.) MATCH: where the employer agrees to contribute some of its own money in the form of what they call a "Match" which has an annual cap limit to it. That means the employer may only match you up until $5k, or $7,500.

3.) YOUR CONTRIBUTION: So if you are contributing $7,500 a year or $625 per month, they are matching up to that. Anything you contribute above and beyond that is 100% all you, the employer will not match over that.

4.) 100% PRE TAX DOLLARS: which means when you pull this out after 65 1/2 years of age, it will be taxed at the THEN TAX RATE. Yikes...

Your SAVING GRACE

The 401k Rollover

There are multiple strategies that one can take to maximize their 401k funds, one of those strategies is a 401k rollover, where you can roll over your "Traditional 401k" into a "Traditional IRA", however you can elect to have it be "Self Directed Traditional IRA" which means you can have some control of where those funds are invested. There are several steps involved to do this which is why we do this for you if you choose at no cost if you are doing wealth planning with us. The only fees you typically have are those imposed by the IRA Custodian. This is also followed heavily by a Self Directed IRA LLC which is another strategy we use to allow you to have full check book control of the funds and can partner with our brother company Obsidian Capital Management Trust.

Old Lingering 401k

What to do with a old 401k

Their are a few options here and if you dont know what your options are its really like rolling the dice. Here are some options.

1.) Leave it with your former employer (Not Recommended)

2.) Roll It Into YOur Current Employers 401k Plan (Not Recommended)

3.) Roll It into a Self Directed IRA (Individual Retirement Account)- A Good Option

4.) Cash it out (but be wary of fees, its best to have a strategy behind this)-A Good Option with a plan

Luckily for you we have your back and can point you in the best direction giving your retirement the SHARPEST EDGE!

The ULTIMATE SAVING GRACE

The 401k To ROTH IRA Rollover

As you can see by now, there are a few various options and some we haven't even told you about because they are our "SECRET SAUCE" that have massive impact on you, your retirement growth, tax savings and more. There is another one that some know about and this is a 401(k) rollover into a ROTH IRA. However because its not a "Traditional IRA" which is pre-tax dollars and ROTH IRA's have ZERO TAX when you draw from it in your retirement years because the money you deposit into it is already taxed. When doing this you will be taxed as ordinary income when you roll this over, now you can roll over some of it every year until all of its rolled over, however your taxation amount may be higher. Again this is why its vital to have a full on wealth plan which includes a tax plan which takes into consideration all of the above. This is by far better to have so you can "SELF DIRECT" it, then obtain a Self Directed IRA LLC (click the button below to learn more about that) which gives you full control of the funds to then place those funds into other investments you choose. We have some that we can recommend that have outstanding growth and diversity.

ENQUIRY

Wait....Do We Have Your Attention Yet?

When you partner with Obsidian Wealth Management for your wealth planning needs, you get a purpose driven company looking to give you the sharpest edge in your wealth planning. Claim your complimentary Tax & Retirement plan by scheduling a strategy session call.

Important Links

Contact

© 2021 Obsidian Wealth Management Trust. All Rights Reserved

.jpg)